Chase Prepaid Card: The Ultimate Guide To Unlocking Financial Freedom

Have you ever wondered what it’s like to have total control over your finances without the hassle of a traditional bank account? Enter the Chase Prepaid Card, a game-changer in the world of personal finance. This isn’t just any prepaid card; it’s a powerful tool that lets you manage your money with ease, security, and flexibility. Whether you’re looking to avoid high bank fees, build better spending habits, or simply gain more control over your financial life, the Chase Prepaid Card might be exactly what you need.

In today’s fast-paced world, having access to a reliable financial solution is more important than ever. With the Chase Prepaid Card, you can enjoy features like direct deposit, mobile banking, and even cash back at participating retailers. It’s like carrying your own personal finance assistant in your pocket. But before you dive in, there’s a lot to learn about how this card works, its benefits, and some things to watch out for. Stick around, and we’ll break it all down for you.

From understanding the basics of prepaid cards to exploring the specific perks of the Chase Prepaid Card, this guide will walk you through everything you need to know. Whether you’re a seasoned budgeter or just starting your financial journey, this article is packed with actionable insights and tips to help you make the most of this innovative financial tool. So, let’s get started!

- Tiktoktrends Suchtipps Was Steckt Hinter Den Aktuellen Videos

- Verhaltensweisen Verstehen Ein Umfassender Leitfaden

What is a Chase Prepaid Card?

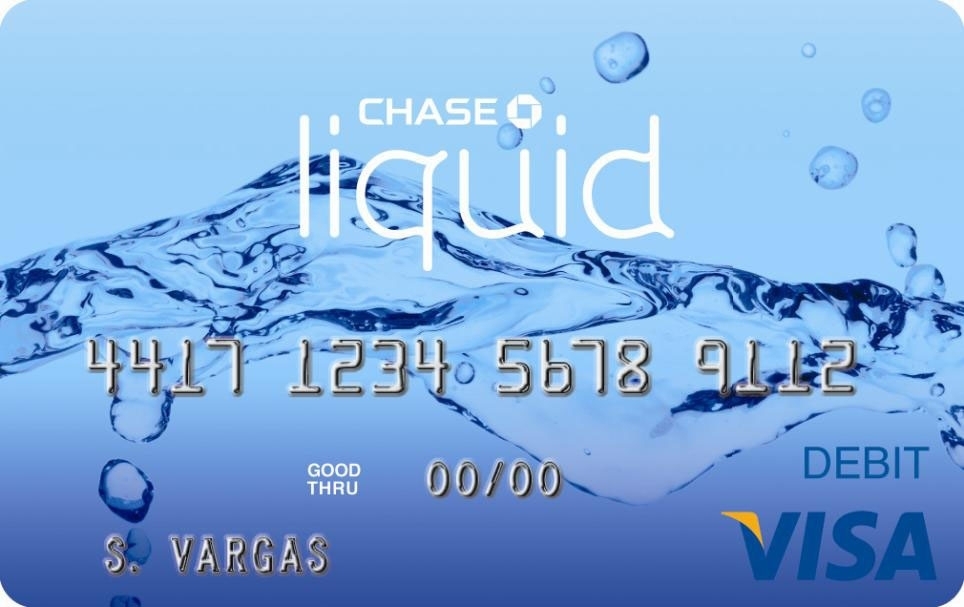

A Chase Prepaid Card is essentially a reloadable debit card that allows you to spend only the money you load onto it. Unlike traditional credit cards, there’s no credit check required to get one, making it an excellent option for people who may not qualify for a regular credit card. You can use it almost anywhere Visa is accepted, and it comes with a host of features that make managing your money easier and more convenient.

One of the biggest advantages of the Chase Prepaid Card is its flexibility. You can reload funds using direct deposit, cash reload networks, or even mobile check deposits. Plus, it offers tools to help you track your spending, set financial goals, and stay on top of your budget. For many people, this card is a stepping stone toward better financial health.

Why Choose the Chase Prepaid Card?

There are plenty of prepaid cards out there, but the Chase Prepaid Card stands out for several reasons. First, it’s backed by one of the most trusted names in banking—Chase. This means you can trust that your money is safe and secure. Second, the card offers features that rival those of traditional bank accounts, such as free ATM withdrawals at Chase branches and no monthly maintenance fees if you meet certain conditions.

- Jinx Manga Kim Dans Schicksal Mehr Top Manga Entdecken

- Radieschen Einlegen So Einfach Gehts Leckere Rezepte

But wait, there’s more! The Chase Prepaid Card also comes with fraud protection and dispute resolution services, giving you peace of mind when you use it online or in-store. Plus, it’s accepted almost everywhere Visa is, so you won’t have to worry about being unable to make a purchase. Whether you’re shopping online, paying bills, or booking travel, this card has got you covered.

Key Features of the Chase Prepaid Card

Let’s take a closer look at some of the standout features of the Chase Prepaid Card:

- Direct Deposit: Get paid up to two days early with direct deposit, which helps you manage your cash flow better.

- Mobile Banking: Check your balance, view transactions, and reload funds right from your smartphone.

- No Monthly Fees: Avoid monthly maintenance fees by loading at least $500 per month or signing up for direct deposit.

- Cash Back: Get cash back at participating retailers when you use your card for purchases.

- ATM Access: Withdraw cash for free at Chase ATMs and get reimbursed for out-of-network ATM fees up to $15 per month.

These features make the Chase Prepaid Card a versatile and convenient option for managing your finances without the need for a traditional bank account.

How Does the Chase Prepaid Card Work?

Using the Chase Prepaid Card is straightforward. Once you load funds onto the card, you can use it wherever Visa is accepted. You can also set up direct deposit to have your paycheck or government benefits automatically loaded onto the card. Additionally, you can add funds through cash reload networks or by depositing checks via the mobile app.

One thing to keep in mind is that while the card is reloadable, it doesn’t offer credit. This means you can only spend the money you’ve loaded onto the card. It’s a great way to avoid overspending and stay within your budget. Plus, the card comes with tools to help you track your spending and manage your finances more effectively.

Step-by-Step Guide to Using the Chase Prepaid Card

Here’s a quick guide to getting started with your Chase Prepaid Card:

- Apply for the card online or in person at a Chase branch.

- Load funds onto the card using direct deposit, cash reload networks, or mobile check deposits.

- Use the card wherever Visa is accepted for purchases, bill payments, and more.

- Track your spending and manage your account through the mobile app or online portal.

- Withdraw cash at Chase ATMs or get cash back at participating retailers.

It’s that simple! With the Chase Prepaid Card, you can take control of your finances and enjoy the convenience of modern banking without the hassle of a traditional bank account.

Benefits of the Chase Prepaid Card

So, why should you consider the Chase Prepaid Card over other prepaid cards on the market? Here are some of the top benefits:

- No Credit Check: You don’t need a credit score to qualify for the card, making it accessible to everyone.

- Security Features: Enjoy fraud protection and dispute resolution services to keep your money safe.

- Convenience: Use the card wherever Visa is accepted, and access your funds through direct deposit, mobile banking, and ATM withdrawals.

- Financial Tools: Take advantage of budgeting tools and spending trackers to help you manage your money more effectively.

- Flexibility: Reload funds whenever you need to, and choose from multiple ways to add money to your card.

These benefits make the Chase Prepaid Card a compelling option for anyone looking to simplify their financial life.

Who Should Use the Chase Prepaid Card?

The Chase Prepaid Card is ideal for a variety of people, including:

- Those who don’t qualify for a traditional bank account or credit card.

- People who want to avoid high bank fees and overdraft charges.

- Individuals looking to build better spending habits and stick to a budget.

- Anyone who values convenience and security in their financial transactions.

Whether you’re a student, a small business owner, or someone just starting out on their financial journey, the Chase Prepaid Card can be a valuable tool in your financial arsenal.

Common Questions About the Chase Prepaid Card

Here are some frequently asked questions about the Chase Prepaid Card:

Is the Chase Prepaid Card Free?

While the Chase Prepaid Card doesn’t have a monthly maintenance fee if you meet certain conditions, there are some fees to be aware of. For example, you may incur fees for out-of-network ATM withdrawals or paper statements. However, these fees are generally lower than those associated with traditional bank accounts, and many can be avoided with careful planning.

Can I Use the Chase Prepaid Card Internationally?

Yes, you can use the Chase Prepaid Card almost anywhere Visa is accepted, including international locations. However, be aware that there may be foreign transaction fees when using the card abroad.

Is the Chase Prepaid Card Secure?

Absolutely! The Chase Prepaid Card comes with fraud protection and dispute resolution services to help keep your money safe. Plus, since you can only spend the money you’ve loaded onto the card, there’s no risk of overspending or going into debt.

Comparing the Chase Prepaid Card to Other Options

When it comes to prepaid cards, there are plenty of options to choose from. So, how does the Chase Prepaid Card stack up against the competition? Here’s a quick comparison:

| Feature | Chase Prepaid Card | Competitor A | Competitor B |

|---|---|---|---|

| No Monthly Fees | Yes, if conditions are met | No | Yes, but with restrictions |

| Direct Deposit | Available | Not available | Limited |

| Mobile Banking | Yes | No | Basic functionality |

| ATM Access | Free at Chase ATMs | Fees apply | Limited network |

As you can see, the Chase Prepaid Card offers a range of features and benefits that make it a top choice for many users.

Tips for Maximizing Your Chase Prepaid Card

Ready to make the most of your Chase Prepaid Card? Here are some tips to help you get the most out of this powerful financial tool:

- Set Up Direct Deposit: This will help you avoid monthly fees and get paid up to two days early.

- Use the Mobile App: Stay on top of your finances by tracking your spending and managing your account on the go.

- Take Advantage of Cash Back: Get cash back at participating retailers to avoid ATM fees.

- Monitor Your Account Regularly: Keep an eye on your transactions to catch any suspicious activity early.

- Reload Strategically: Choose the reload method that works best for you, whether it’s direct deposit, cash reloads, or mobile check deposits.

By following these tips, you can maximize the benefits of your Chase Prepaid Card and take control of your financial future.

Conclusion: Is the Chase Prepaid Card Right for You?

In conclusion, the Chase Prepaid Card offers a flexible, secure, and convenient way to manage your finances. With features like direct deposit, mobile banking, and free ATM access at Chase branches, it’s a great option for anyone looking to simplify their financial life. Whether you’re trying to avoid high bank fees, build better spending habits, or simply gain more control over your money, this card has something to offer.

So, what are you waiting for? If you think the Chase Prepaid Card might be the right fit for you, head over to Chase’s website or visit a local branch to apply. And don’t forget to share your thoughts and experiences in the comments below. We’d love to hear how the Chase Prepaid Card is helping you achieve your financial goals!

Table of Contents:

- What is a Chase Prepaid Card?

- Why Choose the Chase Prepaid Card?

- How Does the Chase Prepaid Card Work?

- Benefits of the Chase Prepaid Card

- Common Questions About the Chase Prepaid Card

- Comparing the Chase Prepaid Card to Other Options

- Tips for Maximizing Your Chase Prepaid Card

- Badxlucy Sexxxtons Was Steckt Dahinter Enthllungen

- Keinemusik Time Warp Alle Infos Und Events In Mannheim

Starbucks and Chase Introduce Rewards Visa Prepaid Card

Living on Capitol Hill Chase Jury Card Prepaid Card Account

Does Chase Liquid have Good Reviews? (Prepaid Debit Card)