Dow Jones Industrial Average Quote: Your Ultimate Guide To Understanding The Market

Let’s talk about something that makes Wall Street tick—literally. The Dow Jones Industrial Average quote is like the heartbeat of the financial world. If you’ve ever wondered what those numbers flashing across your screen mean, you’re in the right place. This isn’t just some random jumble of digits; it’s a reflection of how the biggest companies in America are performing. So, buckle up, because we’re diving deep into the world of stocks, averages, and market trends.

Now, I know what you’re thinking: “Why should I care about the Dow Jones Industrial Average quote?” Well, here’s the deal—whether you’re an investor, a business owner, or just someone curious about how the economy works, understanding the Dow can give you insights into the health of the global economy. It’s not just for financial wizards; it’s for anyone who wants to stay informed.

So, let’s break it down in a way that even your grandma could understand. By the end of this article, you’ll not only know what the Dow Jones Industrial Average quote is but also how it impacts your life. And who knows? You might even impress your friends at your next dinner party with your newfound financial wisdom.

- Trilece Das Ultimative Rezept Geheimnisse Entdecken

- Saramart Gutscheine Sichern Top Angebote Rabatte Im Mai 2025

What Exactly is the Dow Jones Industrial Average?

The Dow Jones Industrial Average, often referred to as the "Dow," is like the golden standard of stock market indicators. It’s been around since 1896, making it one of the oldest stock indexes in the world. But what does it actually represent? Think of it as a snapshot of 30 of the largest and most influential companies in the United States. When people say, “The market is up today,” they’re often referring to the performance of the Dow.

Why the Dow Matters

Here’s the thing: the Dow isn’t just a random collection of stocks. It’s carefully curated to reflect the health of key industries, from technology to healthcare. When the Dow rises, it usually means investors are confident in the future of these companies. Conversely, when it falls, it can signal uncertainty or economic trouble. That’s why everyone from CEOs to everyday investors pays attention to the Dow Jones Industrial Average quote.

Breaking Down the Dow Jones Industrial Average Quote

Alright, let’s get into the nitty-gritty. When you see a Dow Jones Industrial Average quote, what you’re looking at is essentially the price of one “share” of the Dow. But here’s the twist—it’s not a real stock you can buy. Instead, it’s a weighted average based on the stock prices of those 30 companies. Let me explain:

- The Dow is price-weighted, meaning stocks with higher prices have more influence on the index.

- It’s calculated by dividing the sum of the stock prices by a divisor that accounts for stock splits and other changes.

- So, if a company’s stock price increases, it can have a bigger impact on the overall Dow quote compared to a company with a lower-priced stock.

How the Dow is Calculated

Let’s say you want to calculate the Dow yourself (because why not, right?). Here’s a simplified version of the formula:

Dow Jones Industrial Average = Sum of Stock Prices / Dow Divisor

Now, don’t panic if math isn’t your thing. Most people rely on financial news outlets or online platforms to get the latest Dow Jones Industrial Average quote. But understanding the calculation helps you appreciate how changes in individual stock prices can ripple through the entire index.

Top Companies in the Dow Jones

So, who’s part of this exclusive club? The 30 companies in the Dow Jones Industrial Average are some of the biggest names in business. Here’s a quick rundown:

- Apple Inc.

- Microsoft Corporation

- Johnson & Johnson

- Walmart Inc.

- Coca-Cola Company

- And many more…

These companies represent a wide range of industries, from tech to consumer goods. But here’s the kicker—they’re not permanent members. The Dow committee reviews the list regularly and makes changes based on market conditions and industry shifts.

Why These Companies Were Chosen

It’s not just about size. The companies in the Dow are selected because they’re leaders in their respective fields. They have a proven track record of success and are considered bellwethers for the overall economy. If these companies are doing well, chances are the rest of the market is too.

Historical Performance of the Dow

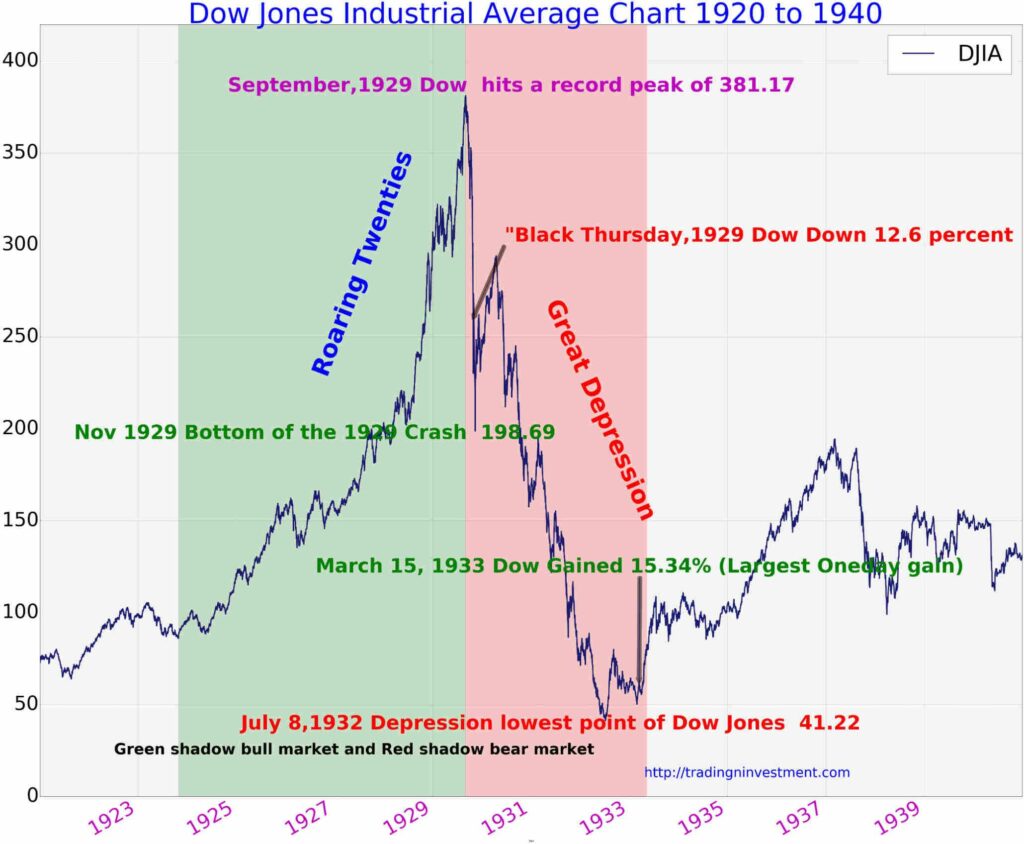

Let’s take a trip down memory lane. The Dow Jones Industrial Average has seen its fair share of ups and downs over the years. From the Great Depression to the dot-com boom, it’s been a rollercoaster ride. But one thing’s for sure—it’s always bounced back. Here are some key moments in the Dow’s history:

- In 1929, the Dow crashed, marking the start of the Great Depression.

- By 1999, it had surged past the 10,000 mark during the tech boom.

- During the 2008 financial crisis, the Dow plummeted but eventually recovered.

These historical trends show that while the market can be volatile, long-term investors tend to come out on top.

Learning from History

Studying the Dow’s past performance can teach us valuable lessons about risk and reward. It reminds us that markets can be unpredictable, but they also offer opportunities for growth. Whether you’re a seasoned investor or just starting out, understanding the Dow’s history can help you make informed decisions.

How to Read the Dow Jones Industrial Average Quote

Alright, let’s talk about the actual numbers. When you see a Dow Jones Industrial Average quote, you’ll usually see two things:

- The current value of the Dow (e.g., 35,000).

- The change from the previous day (e.g., +200 points or -150 points).

But what do these numbers really mean? A positive change indicates that the overall market is up, while a negative change suggests it’s down. The percentage change is also important because it gives you a sense of how significant the movement is.

Understanding Fluctuations

Market fluctuations are normal, but they can still be nerve-wracking. A sudden drop in the Dow Jones Industrial Average quote doesn’t necessarily mean the sky is falling. It could be due to a variety of factors, from geopolitical tensions to economic reports. That’s why it’s important to look at the bigger picture and not react impulsively to daily changes.

Factors Influencing the Dow

So, what makes the Dow move? There are several factors at play:

- Economic indicators like employment data and GDP growth.

- Corporate earnings reports and dividend announcements.

- Global events, such as trade agreements or political instability.

Each of these factors can have a ripple effect on the market, influencing how investors perceive the future of the companies in the Dow.

Staying Informed

Keeping up with the latest news and trends is crucial if you want to understand the Dow Jones Industrial Average quote. Subscribe to financial news outlets, follow industry experts on social media, and regularly check market updates. Knowledge is power, especially when it comes to investing.

Investing in the Dow

If you’re thinking about investing in the Dow, there are a few things you should know. First, you can’t invest directly in the Dow itself. Instead, you can invest in exchange-traded funds (ETFs) or mutual funds that track the Dow. This gives you exposure to the performance of the 30 companies in the index.

Risks and Rewards

Like any investment, there are risks involved. While the Dow has a strong track record of growth, there’s no guarantee of future performance. That’s why it’s important to diversify your portfolio and consider your risk tolerance before jumping in.

Conclusion: Why the Dow Matters to You

Let’s recap: the Dow Jones Industrial Average quote is more than just a number. It’s a reflection of the health of the U.S. economy and a valuable tool for investors. Whether you’re monitoring the market for fun or profit, understanding the Dow can give you a competitive edge.

So, what’s next? Take a moment to reflect on what you’ve learned. Maybe start tracking the Dow on a daily basis or dive deeper into the companies that make up the index. And don’t forget to share this article with your friends! The more people understand the Dow, the better equipped we all are to navigate the ever-changing world of finance.

Table of Contents

- What Exactly is the Dow Jones Industrial Average?

- Breaking Down the Dow Jones Industrial Average Quote

- Top Companies in the Dow Jones

- Historical Performance of the Dow

- How to Read the Dow Jones Industrial Average Quote

- Factors Influencing the Dow

- Investing in the Dow

- Conclusion: Why the Dow Matters to You

There you have it—a comprehensive guide to the Dow Jones Industrial Average quote. Now go out there and impress the world with your newfound financial knowledge!

- Mega Lecker Wraps Mit Hackfleisch Das Musst Du Probieren

- Ltere Frauen Spa Entdecke Heie Milfs Mehr Neue Videos

Dow Jones Industrial Average closes above 40,000 for the first time

Dow Jones Industrial Average Stock Quote ShortQuotes.cc

Dow Jones Industrial Average on Blue Stock Illustration Illustration