Property Taxes In Los Angeles County: The Ultimate Guide For Homeowners

Property taxes in Los Angeles County are more than just numbers on a bill. They’re a vital part of what keeps the city running, from funding schools to maintaining infrastructure. If you’re a homeowner or planning to buy a home in LA, understanding property taxes is key to making smart financial decisions. But let’s be real, tax laws can get pretty confusing, right? Don’t worry—we’ve got your back.

Let’s break it down in a way that’s easy to digest, even if you’re not a tax expert. Think of property taxes as the “membership fee” for living in one of the most vibrant counties in California. It’s how the government ensures that roads are paved, schools are funded, and public services keep humming along. Whether you’re a long-time resident or a newbie, this guide will help you navigate the ins and outs of property taxes in LA County.

We’ll dive into the nitty-gritty details, from how property taxes are calculated to what deductions you might qualify for. By the end of this article, you’ll feel like a pro when it comes to understanding your tax bill. So grab a cup of coffee, sit back, and let’s get started!

- Wetterchaos Am Flughafen Zrich Aktuelle Infos Prognosen

- Gay Dating Mehr Was Sie Ber Blowers Co Wissen Sollten

Understanding Property Taxes in Los Angeles County

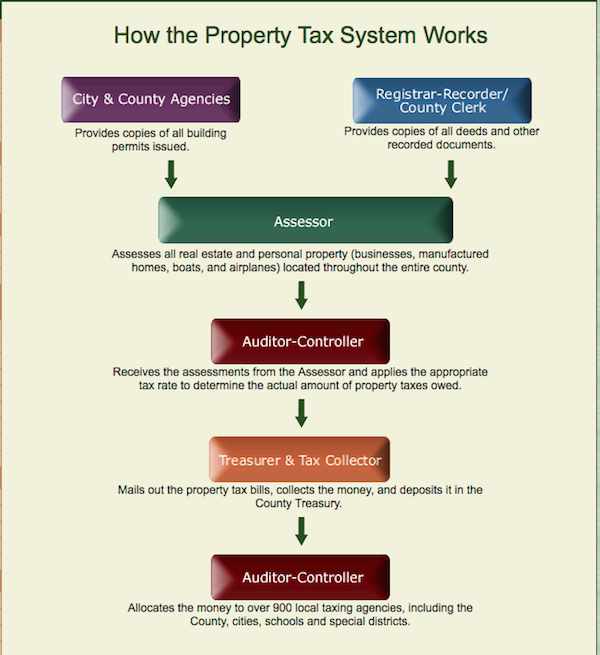

Property taxes are a big deal in LA County, and they’re calculated based on the assessed value of your property. But what does that mean exactly? The assessed value is typically lower than the market value, which is a good thing for homeowners. The county assessor evaluates your property every year to determine its taxable value. This process ensures that everyone pays their fair share while keeping things fair across the board.

Here’s the kicker: property taxes in LA County are capped at 1% of the assessed value, thanks to Proposition 13, a law passed back in 1978. That means even if your home’s market value skyrockets, your tax bill won’t skyrocket with it—at least not immediately. However, there are additional fees and assessments that can bump up your total tax bill, so it’s important to stay informed.

How Are Property Taxes Calculated?

The formula for calculating property taxes might seem complicated at first, but it’s actually pretty straightforward once you break it down. Here’s how it works:

- Assessed Value: The county assessor determines the value of your property based on factors like location, size, and improvements.

- Tax Rate: In LA County, the base tax rate is 1%, but additional assessments and fees can increase this rate.

- Total Tax Bill: Multiply the assessed value by the tax rate, and voilà—you’ve got your property tax bill.

For example, if your home’s assessed value is $500,000, your base tax would be $5,000 (1% of $500,000). But remember, additional assessments like school bonds or community facilities districts could add a few hundred dollars to that number. It’s always a good idea to check your tax bill carefully to make sure everything adds up.

Key Factors That Affect Property Taxes

Several factors can influence how much you pay in property taxes. Let’s take a closer look at some of the most important ones:

Location, Location, Location

Where you live in LA County can have a big impact on your property tax bill. Some areas have higher assessed values due to their desirability, while others may have additional assessments for things like water districts or park improvements. It’s like the old real estate adage says: location is everything.

Home Improvements

Making significant upgrades to your home—like adding a pool or expanding your living space—can increase your property’s assessed value. While these improvements boost your home’s market value, they can also lead to higher property taxes. It’s a trade-off that many homeowners are willing to make, but it’s something to keep in mind when planning renovations.

Proposition 13: The Cornerstone of Property Tax Law

Proposition 13 is a game-changer when it comes to property taxes in California. Enacted in 1978, this law limits the amount that property taxes can increase each year to no more than 2%. This cap helps protect homeowners from sudden spikes in their tax bills, even if property values in their area are rising rapidly.

Here’s how it works: let’s say you bought a home for $300,000 ten years ago, and now its market value is $700,000. Under Proposition 13, your assessed value would only increase by 2% each year, so your tax bill would remain manageable. Without this protection, homeowners could face skyrocketing taxes that make it difficult to keep up with payments.

Additional Assessments and Fees

While the base tax rate in LA County is capped at 1%, there are additional assessments and fees that can add to your total tax bill. These might include:

- School Bonds: Local school districts often issue bonds to fund improvements, and homeowners may be required to pay a portion of these costs.

- Community Facilities Districts (CFDs): Also known as Mello-Roos districts, these assessments fund specific community projects like parks or libraries.

- Water and Sewer Fees: Some areas charge additional fees for water and sewer services, which are included in your property tax bill.

It’s important to review your tax bill carefully to understand what you’re paying for. If you have questions about any of these assessments, don’t hesitate to reach out to your local tax assessor’s office for clarification.

Exemptions and Deductions You Should Know About

There are several exemptions and deductions available to homeowners in LA County that can help lower your property tax bill. Here are a few to keep in mind:

Homeowner’s Exemption

If you’re a homeowner who uses your property as your primary residence, you may qualify for a $7,000 reduction in your assessed value. This exemption can save you around $70 per year on your property taxes. To claim this benefit, you’ll need to file an application with the county assessor’s office.

Senior Citizen Exemption

Homeowners over the age of 55 may be eligible for additional tax breaks, including a one-time exclusion from reassessment when selling a home and buying a new one of equal or lesser value. This can be a huge relief for seniors who want to downsize without worrying about a big tax hit.

How to Appeal Your Property Tax Assessment

If you believe your property tax assessment is too high, you have the right to appeal. The process involves submitting a formal request to the county assessor’s office and providing evidence to support your case. This might include recent sales of comparable properties in your area or an independent appraisal of your home.

Here’s a step-by-step guide to appealing your property tax assessment:

- Gather Evidence: Collect data on recent property sales and appraisals to show that your assessed value is too high.

- File an Appeal: Submit your appeal to the county assessor’s office by the deadline, which is usually in September.

- Attend a Hearing: If your appeal is accepted, you’ll have the opportunity to present your case at a hearing.

Keep in mind that appealing your assessment doesn’t guarantee a reduction in your taxes, but it’s worth a shot if you believe the assessed value is inaccurate.

Common Misconceptions About Property Taxes

There’s a lot of misinformation out there about property taxes, so let’s clear up a few common myths:

Myth #1: Property Taxes Are Fixed

Fact: Property taxes can change from year to year based on factors like reassessments, new assessments, and changes in the tax rate.

Myth #2: You Can’t Appeal Your Assessment

Fact: As we discussed earlier, homeowners have the right to appeal their property tax assessment if they believe it’s unfair or inaccurate.

Resources for Homeowners

Here are some helpful resources to help you stay informed about property taxes in LA County:

- LA County Assessor’s Office: Visit their website to learn more about property tax laws and find tools to estimate your tax bill.

- California Board of Equalization: This agency provides guidance on property tax appeals and exemptions.

- Tax Professionals: If you’re feeling overwhelmed, consider consulting a tax professional who specializes in property taxes.

Conclusion

Property taxes in Los Angeles County might seem daunting at first, but with a little knowledge and preparation, you can navigate them with confidence. From understanding how they’re calculated to exploring exemptions and deductions, there’s a lot to learn—but it’s all worth it in the end.

So, what’s the next step? If you’re a homeowner, make sure you’re taking advantage of all the available exemptions and deductions. If you’re thinking about buying a home in LA County, do your research to understand how property taxes will impact your budget. And don’t forget to stay informed about changes in tax laws that could affect you in the future.

We’d love to hear your thoughts! Leave a comment below to share your experiences with property taxes in LA County, or check out our other articles for more tips and insights. Together, we can make sense of the world of property taxes—one bill at a time!

Table of Contents

- Understanding Property Taxes in Los Angeles County

- How Are Property Taxes Calculated?

- Key Factors That Affect Property Taxes

- Proposition 13: The Cornerstone of Property Tax Law

- Additional Assessments and Fees

- Exemptions and Deductions You Should Know About

- How to Appeal Your Property Tax Assessment

- Common Misconceptions About Property Taxes

- Resources for Homeowners

- Conclusion

- Wochenende Gerettet Lustige Sprche Fr Dich Tipps

- Hintere Schulter Trainieren Die Besten Bungen Fr Dich

Los Angeles County Investment Properties Long Beach CA

Copy Of A Property Tax Bill For LA County Property Tax Los Angeles

Los Angeles Property Tax Which Cities Pay the Least and the Most?