Kohls Charge Card: Your Ultimate Guide To Shopping Smarter

Have you ever heard about the Kohl's Charge Card? If you're a fan of shopping, this card could be your best friend. Think of it as a secret weapon that not only helps you save money but also earns you Kohl's Cash. Who doesn’t love cashback, right? But before you jump into the world of Kohl's Charge Card, let me break it down for you in a way that’s easy to understand and super useful. Whether you’re a casual shopper or a hardcore bargain hunter, this guide is going to give you all the insights you need.

Shopping at Kohl's can sometimes feel like a treasure hunt, especially when you're trying to find deals. That's where the Kohl's Charge Card comes in. It’s more than just a credit card—it’s a tool that helps you unlock discounts, cashback, and other perks that make shopping so much more rewarding. In this article, we’ll dive deep into everything you need to know about the card, from how it works to its benefits and even some tips to help you maximize your savings.

Whether you're a first-time user or someone who’s been using the Kohl's Charge Card for years, there’s always something new to learn. We’ll cover the basics, the perks, and even some strategies to ensure you’re making the most of your card. So, let’s get started and make shopping smarter and more fun!

What is Kohls Charge Card?

The Kohl's Charge Card is a store-specific credit card designed exclusively for shoppers at Kohl's. It’s like having a VIP pass that gives you access to exclusive discounts, special offers, and Kohl's Cash. The card is available in two versions: the Kohl's Charge Card and the Kohl's Visa Credit Card. While both offer similar benefits, the Visa card allows you to use it at other merchants, not just Kohl's.

One of the coolest features of the Kohl's Charge Card is the Kohl's Cash program. This program rewards you with cashback on specific purchases, which you can then use toward future purchases. Think of it as a loop of savings that keeps on giving. The card also offers 0% introductory APR for a limited time, making it easier to finance larger purchases without breaking the bank.

Why Choose Kohls Charge Card?

There are plenty of reasons why the Kohl's Charge Card stands out from other store credit cards. First and foremost, it’s designed to help you save money. Whether you’re buying clothes, home goods, or electronics, the card offers discounts that you won’t find anywhere else. Plus, the Kohl's Cash program is a game-changer when it comes to saving on future purchases.

Another advantage is the convenience. With the Kohl's Charge Card, you can shop online or in-store without worrying about carrying cash or multiple credit cards. It’s a streamlined way to manage your shopping expenses while still enjoying the perks of being a loyal Kohl's customer.

Benefits of Using Kohls Charge Card

So, what exactly do you get when you sign up for the Kohl's Charge Card? Let’s break it down into some key benefits:

- Exclusive Discounts: Cardholders enjoy special discounts that aren’t available to regular shoppers. This includes early access to sales and exclusive promotions.

- Kohl's Cash Program: Earn cashback on certain purchases that can be redeemed for future shopping trips. It’s like getting free money to spend at Kohl's.

- 0% Introductory APR: For a limited time, you can finance larger purchases without paying interest. This is perfect for buying big-ticket items like furniture or appliances.

- Convenience: Use the card both online and in-store, making it easy to shop wherever you prefer.

- No Annual Fee: The Kohl's Charge Card doesn’t charge an annual fee, so you can enjoy all the perks without worrying about hidden costs.

These benefits make the Kohl's Charge Card a smart choice for anyone who shops regularly at Kohl's. But remember, with great power comes great responsibility. Always make sure you’re using the card responsibly to avoid any unnecessary debt.

How Does Kohls Cash Work?

Kohl's Cash is one of the most attractive features of the Kohl's Charge Card. Here’s how it works: when you make certain purchases with your card, you earn Kohl's Cash certificates. These certificates can then be used toward future purchases, effectively giving you cashback on your shopping.

For example, if you spend $100 on eligible items, you might receive a $10 Kohl's Cash certificate. You can use this certificate during your next visit to Kohl's, either online or in-store. It’s like getting a discount on top of your regular savings. Plus, the more you spend, the more Kohl's Cash you can earn, so it’s a win-win situation.

Eligibility and Application Process

Anyone can apply for the Kohl's Charge Card, but approval depends on your credit history and financial standing. The good news is that the application process is quick and easy. You can apply online or in-store, and you’ll typically receive an answer within minutes.

When applying, you’ll need to provide some basic information, such as your name, address, Social Security number, and income. Kohl's will review your credit history to determine your eligibility and credit limit. If you’re approved, you’ll receive your card in the mail, usually within 7-10 business days.

Tips for Getting Approved

Here are a few tips to increase your chances of getting approved for the Kohl's Charge Card:

- Check Your Credit Score: A higher credit score improves your chances of approval and a better credit limit.

- Provide Accurate Information: Make sure all the information you provide during the application process is accurate and up-to-date.

- Be Honest About Your Income: Don’t overestimate your income. Lenders prefer honesty over exaggeration.

- Pay Down Existing Debt: If you have other credit cards or loans, try to pay them down before applying to improve your debt-to-income ratio.

By following these tips, you can increase your chances of getting approved for the Kohl's Charge Card and start enjoying its many benefits.

Managing Your Kohls Charge Card

Once you have your Kohl's Charge Card, it’s important to manage it responsibly. Here are some tips to help you stay on top of your finances:

- Set Up Automatic Payments: This ensures you never miss a payment and helps you avoid late fees.

- Monitor Your Account: Keep an eye on your account activity to spot any unauthorized transactions.

- Use the Card Wisely: Only use the card for purchases you can afford to pay off in full each month to avoid interest charges.

- Take Advantage of Perks: Don’t forget to use your Kohl's Cash certificates and other rewards to maximize your savings.

By managing your Kohl's Charge Card responsibly, you can enjoy all the benefits it offers without worrying about debt or fees.

Avoiding Common Pitfalls

While the Kohl's Charge Card has many advantages, there are a few pitfalls to watch out for:

- Carrying a Balance: If you don’t pay off your balance in full each month, you’ll be charged interest, which can add up quickly.

- Missing Payments: Late payments can damage your credit score and result in fees.

- Overusing the Card: It’s easy to get carried away with the discounts and rewards, but remember to shop within your budget.

By being aware of these potential pitfalls, you can avoid them and enjoy a positive experience with your Kohl's Charge Card.

Comparing Kohls Charge Card with Other Store Cards

When it comes to store credit cards, the Kohl's Charge Card stands out for several reasons. Here’s how it compares to other popular store cards:

- Discounts: Kohl's offers some of the best discounts and cashback programs among store cards.

- Convenience: The ability to use the card both online and in-store gives you more flexibility than some other store cards.

- No Annual Fee: Many store cards charge an annual fee, but the Kohl's Charge Card doesn’t.

- Introductory APR: The 0% introductory APR makes it easier to finance larger purchases without interest.

While other store cards may offer similar benefits, the combination of discounts, Kohl's Cash, and convenience makes the Kohl's Charge Card a top choice for shoppers.

Who Should Get Kohls Charge Card?

The Kohl's Charge Card is ideal for anyone who shops regularly at Kohl's. Whether you’re buying clothes, home goods, or electronics, the card offers discounts and rewards that make shopping more affordable and enjoyable. If you’re a loyal Kohl's customer, this card is definitely worth considering.

However, if you only shop at Kohl's occasionally, you might want to think twice. The card’s benefits are most valuable for frequent shoppers who can take full advantage of the discounts and cashback programs. For infrequent shoppers, the benefits may not outweigh the potential drawbacks.

Conclusion

The Kohl's Charge Card is a powerful tool for anyone who loves shopping at Kohl's. With its exclusive discounts, Kohl's Cash program, and 0% introductory APR, it offers a range of benefits that make shopping smarter and more rewarding. By managing the card responsibly and taking advantage of its perks, you can save money and enjoy a more convenient shopping experience.

So, what are you waiting for? If you’re a regular Kohl's shopper, consider applying for the Kohl's Charge Card today. And don’t forget to share your thoughts and experiences in the comments below. Your feedback helps other shoppers make informed decisions about their financial choices. Happy shopping!

Table of Contents

- What is Kohls Charge Card?

- Why Choose Kohls Charge Card?

- Benefits of Using Kohls Charge Card

- How Does Kohls Cash Work?

- Eligibility and Application Process

- Tips for Getting Approved

- Managing Your Kohls Charge Card

- Avoiding Common Pitfalls

- Comparing Kohls Charge Card with Other Store Cards

- Who Should Get Kohls Charge Card?

Kohl's Capital One Credit Card Login

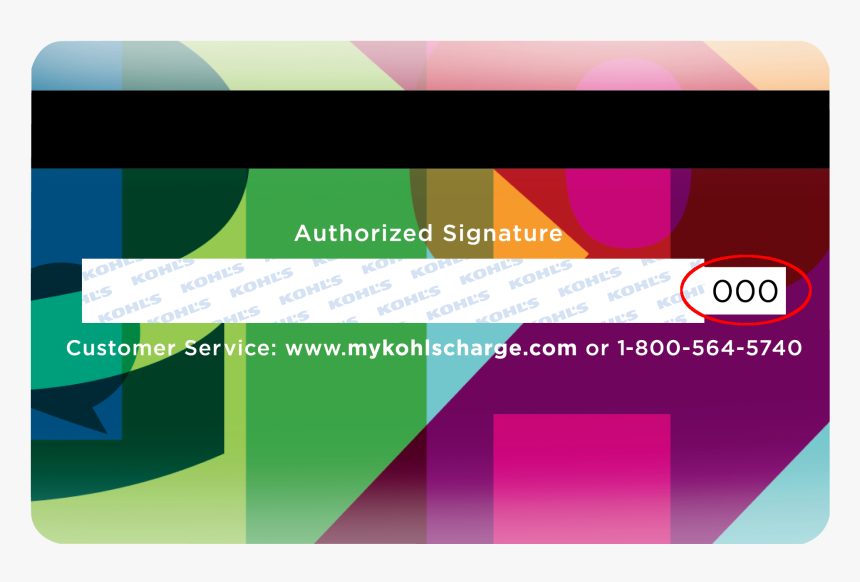

Image Kohl's Charge Card Back, HD Png Download kindpng

Kohls Charge On Credit Card Statement [Explained]